Build Your Personal Monopoly ⚡

Morning friends!

Having a great week over there? Month? YEAR??

All good and happy on these fronts… I’m healthy, busy (on things I want to be busy on!), and lately – excited for a couple new possible projects that may be lurking around the corner. One with my old philanthropy buddy, Nate St. Pierre!

Gotta keep that brain active so it doesn’t turn into a prune 😎

I’ve also been enjoying being back at the blog again after accidentally taking half the year off.

Ponder the titles of these last two posts of mine and see if any look interesting enough to click! They’re both super helpful, but in completely different ways:

*******

I froze my credit and it was SO EASY! (And Free)

(Took under 15 minutes, and I share the three links you need to click on so you can promptly forget about it all and move on with your (hack-free) life too! Cuz ain’t nobody gots the time – or desire – to mess around with identity theft!)

You must begin from where you are

(A handful of inspirational one-liners from yoga that very much applies to finances too. And if you can believe it, it’s now been 1 year straight of doing yoga for me and I’ve literally taken over 250 classes in that time frame! Someone stop me!! ;))

*******

Lastly, the blog buying/selling game has been hot these last couple of months, so I’ve been busy connecting people and helping make some fun deals.

If you’ve ever thought of scooping up a blog or financial biz to expand your portfolio (or you’re looking to sell one!) hit me up and we can discuss. You can also sign up to my (free) private buyer’s list where you’ll get notified any time a new blog or financial biz from the community comes on the market: Blogs For Sale

We’ve currently got two sites looking for a new home:

- YoungFinances.com ($7,500) – a 14 y/o personal finance blog

- Emancipare.com ($99,000) – a boutique financial planning business

DM me for more info!

Other favorite reads from around the community this month down below…

Thanks for reading! Let me know what you’ve been up to lately! :)

XOXO,

*******

Favorite Reads From Around the Community:

Don’t Give In To That First Desire via Darius Foroux — “Benjamin Franklin, one of the founding fathers of the United States, once said something that helps with managing our first impulsive desire: ”‘Tis easier to suppress the first desire than to satisfy all that follow it.” This is a timeless truth about human nature and how we’re constantly pursuing our first desire. ”

Why I Have a Secret “Classified” Email Address via Wallet Hacks — “The United States Government has classified and unclassified systems and the basic premise is that the two shall never meet. Sensitive and important information lives in the classified world. Less important, less sensitive information lives in the unclassified world… This is what I do with my email system.”

AI That Works: How To Build A Youbot via Nate St. Pierre – “A Youbot is a personalized AI assistant that functions as a supercharged extension of yourself. It’s built to understand your background, your goals, and your needs already in context, so you don’t have to explain everything every time you need help. Youbots are designed to work with the same kind of background information that anyone close to you would already know, but they bring that information into the conversation instantly, and at a much larger scale.” [This is a project by my bestie who I might be partnering up with to expand this! AI is here to stay no matter how anyone feels about it, so why not harness it to improve your life?]

Build a Personal Monopoly via David Perell — “When you build your Personal Monopoly, you say yes to playing a worldwide game that most people don’t even know exists. Forge a distinct path instead of copying what everybody else is doing. Work on ambitious projects, study the unexplored intersections of ideas and find the questions that people are asking but nobody is answering.”

A Smartphone That Can Charge Itself From Sunlight via Tech Radar — “Imagine a world where your smartphone charges itself simply by being exposed to sunlight, with no cords or power outlets required. Researchers have long sought ways to integrate renewable energy into everyday objects, and this futuristic vision is now closer to reality, thanks to a breakthrough that could potentially allow devices to charge directly through their screens.” [Hat tip AGaiShanLife.com]

On Becoming Who You Are via Nate St. Pierre — “If I can give you a piece of advice that’s resonated with me over the years, it’s to never be afraid to be who you are. Don’t do what everyone else is doing just because you think it’s expected of you or because you’re afraid of being judged. Be your authentic self, believe what you believe, love what you do, and you’ll find your life’s work along with your community of kindred spirits.” [Two articles from the same person today! But I couldn’t pass it up – goes in line so much with the theme of building your own personal monopoly 💪 (Plus it just gave me all the feels)]

Shaq on Being Blown Away by Investing in Ring via Moneywise — “Despite being a multimillionaire, NBA legend Shaquille O’Neal balked when a private contractor quoted him a staggering $80,000 to upgrade his home security. Instead of paying up, Shaq did what most of us would do — he opted for a DIY solution. He headed to Best Buy, bought a set of Ring security cameras, and took matters into his own hands. “I hooked it up myself…”

Metric-Less Success via More To That – “Traditional success will get you on magazine covers, but metric-less success will get you on family albums. While society as a whole worships quantifiable success, what will ultimately matter most to the individual is everything that can’t be counted.”

*******

Juicy Blogger News:

- Darcy at We Want Guac reaches $500k net worth!

- Financial Mechanic hits 2 years of early retirement

- Accidentally Retired hits 4 years of early retirement

- A Purple Life also hits 4 years of early retirement!

******

Poem of The Month:

Wild Geese, by Mary Oliver

“You do not have to be good.

You do not have to walk on your knees

for a hundred miles through the desert repenting.

You only have to let the soft animal of your body

love what it loves.

Tell me about despair, yours, and I will tell you mine.

Meanwhile the world goes on.

Meanwhile the sun and the clear pebbles of the rain

are moving across the landscapes,

over the prairies and the deep trees,

the mountains and the rivers.

Meanwhile the wild geese, high in the clean blue air,

are heading home again.

Whoever you are, no matter how lonely,

the world offers itself to your imagination,

calls to you like the wild geese, harsh and exciting—

over and over announcing your place

in the family of things.”

[via Financial Mechanic]

*******

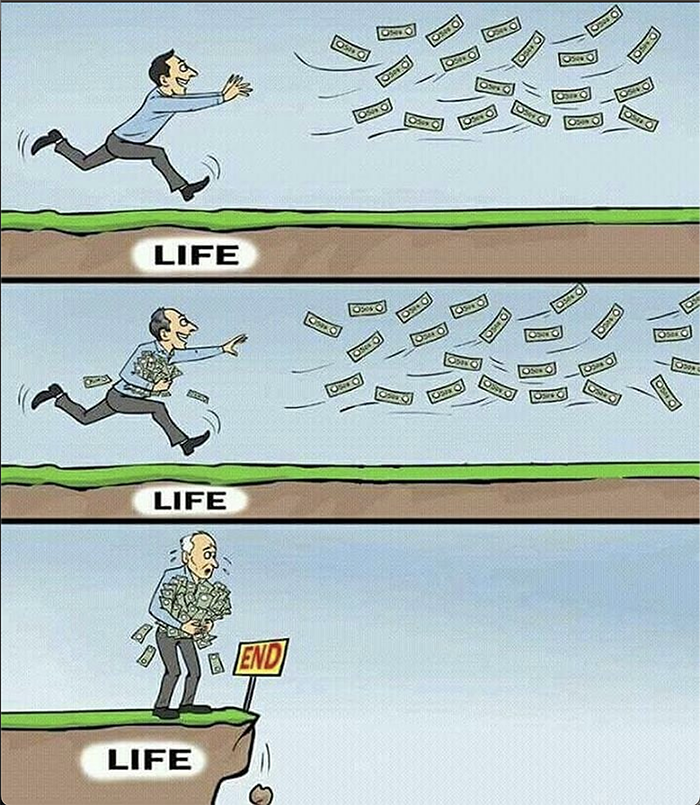

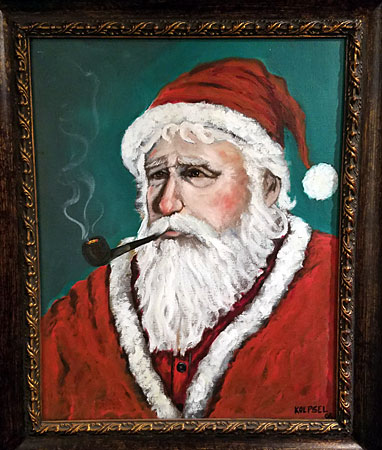

Pic of The Month:

[Great reminder to be careful of what you’re chasing!

Snagged from The Belle Curve]

Have a fantastic weekend ✨

// Robot pic up top by Nate St. Pierre – made with AI!

// For previous newsletters: Archives

// To connect further: @Twitter | @Facebook | @Instagram | @LinkedIn