Why Saving The First $10,000 Is Critical

Good morning friends!

Hope you’re having a fantastic New Years so far, and didn’t get too much coal for Xmas like me :)

It’s been a whirlwind of events over here, between family events and kid stuff and the holidays, and then *right* when we were about to get back to normal again the SNOW came in and hit us! Over 10 inches which we never get! The kids were ecstatic, of course, but man it’s finally nice to be back to a regular schedule again…

I did somehow manage though to shoot out a couple of new posts on the blog:

I would rather play chicken with my bills than with my savings

(A pretty interesting chat with a fellow coffee shop goer! Where I repeatedly had to ask him to repeat what he just said to make sure I got it down correctly 😂 A few of my favorites were: “I spend a lot of money looking for women”, “I threw away my debit cards”, and “I would rather play chicken with my bills than with my savings”)

“The Purpose Code” – New Book and Giveaway!

(Giving away a blogger friend’s latest book, centered around one of those things that occupies my brain way more than I care to admit: the purpose of life! Which apparently I’m not alone in, as this “purpose anxiety” has been proven to affect 91% of people! Crazy!)

Give them a shot if you’re looking for some fun reading this morning! Or continue browsing down below to other great articles I’ve bookmarked from around the community…

Hope you’re doing well so far this year!! Any big plans or events or goals??! I don’t really set New Year resolutions anymore as I’m *always* working on some sort of challenge over here, but I do still think they’re great for those needing a little motivation! And hopefully no one’s given up on them yet!

Have a fantastic weekend ☕

PS: check out these stickers I saw on a car recently – our type of person! :)

*******

Favorite Reads Around the Community:

Why Saving The First $10,000 Is Critical via Wallet Hacks — “Your first goal is to save up $1,000. Scratch and claw your way to $1,000. Then, set your sights on $10,000. $10,000 is far but within reach. It’s also a sum that can be attained through the cutting of expenses and budgeting. You can save your way to $10,000. Then, invest that $10,000… If you don’t, you will forever be trading your time for money.”

The One-Box Challenge: A Simple Trick for a Clutter-Free Life via The Frug — “If you’re interested in decluttering your life but find it challenging to get started, I’ve devised a straightforward method to keep you on track every day. We’ve placed a sizable cardboard box in our hallway, right next to the hamper. Anytime Kelly or I stumble upon something we no longer use or want, it finds a new home in this box. Typically, after about a month, the box is nearly full, and it’s time to swiftly pack it up and transport it to Goodwill. ”

How it’s going after a full week without caffeine via George Poulos — “At what point does discipline cross over the line from being beneficial into a toxic form of self-restriction? As far as I can tell, life seems to be a constant process of experimentation, a never-ending balancing act and oscillation between these two ways of being.”

How to Avoid Getting Lost in Thought via Raptitude — “Humans [have] evolved the ability to hallucinate stuff we’re not presently sensing. We can summon to mind images of territories that exist elsewhere or even nowhere. Money we haven’t earned yet. Predators we’ve never encountered. Disappointments we haven’t suffered yet… This ability has allowed us to build cities, establish moral codes, and go to the moon, but it also presents a huge liability: confusion about what’s there and what’s merely being thought about.”

Don’t Take the Market Personally via A Wealth of Common Sense — “The stock doesn’t know you own it. All those marvelous things, or those terrible things, that you feel about a stock, or a list of stocks, or an amount of money represented by a list of stocks, all of these things are unreciprocated by the stock or the group of stocks. You can be in love if you want to, but that piece of paper doesn’t love you, and unreciprocated love can turn into masochism, narcissism, or, even worse, market losses and unreciprocated hate.”

When ‘Ho Ho Ho’ Turns to ‘Owe, Owe Owe’: 5 Financial New Year’s Resolutions for 2025 via USA Today [Shameless plug as I was featured in it! ;)]

Leaving Things Better Than We Found Them via Frugal Girl — “I don’t think it’s possible to do it perfectly, but I want to live my life so that the places I’ve been and the people I’ve interacted with are better for me having been there.”

*******

Book Spotlight:

The Purpose Code: How to unlock meaning, maximize happiness, and leave a lasting legacy . This book comes from fellow PF’er, Jordan Grumet of Earn & Invest podcast, and in celebration of its release we’re giving away a few copies of it over at Budgets Are Sexy! So be sure to click over there next and enter if you’re interested in it!

More about the book via Amazon:

“Worried about purpose? Most people are. But no one has to be. Brené Brown meets Malcolm Gladwell in this ground-breaking self-improvement book that reveals how to make a mark and how to set goals in life without falling into the anxiety traps of conventional success principles books. The ultimate in purpose anxiety relief, and a map for anyone to find happiness.”

*******

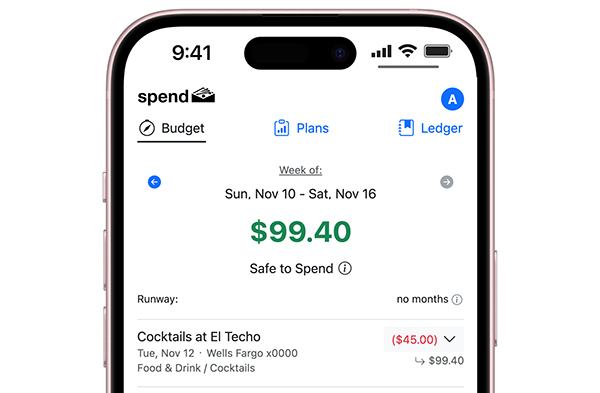

APP Spotlight:

Spend — This is a new’ish budgeting app a colleague of mine is working on… I haven’t tried it yet but according to him once people check it out they tend to stay. So maybe give it a shot if you still haven’t found a good Mint replacement? I do really like its “Safe to Spend” feature.

(They have a free version and a paid version ($7.99/mo or $79/yr), but he’s currently running a promotion for anyone who signs up in January: access to the paid version for 1 entire year – free. Let me know if you test it out!)

*******

*Links to Book are Amazon affiliate links

// For previous newsletters: Archives

// To connect further: @Twitter | @Facebook | @Instagram | @LinkedIn

Leave a Reply