Introducing my latest project: YouBots.ai!

Hi guys!!

So a project we’ve been working on hard behind the scenes for the past handful of months is finally live!

Introducing….

YouBots.ai – A suite of advanced, powerful marketing tools powered by AI!

It’s not the usual financial field I dabble in (though it can save you a ton of money if you’re a business owner!), but I owe it to my partner in crime whose been absolutely obsessed with AI this past year to the point where he’s changed his entire career around it.

He started building out these customized AI-powered “bots” for companies and selling them for thousands of dollars a pop, and after watching him for a few months I asked why he just doesn’t package them all up under one roof and offer them up to *everybody*? Kinda like the world’s first AI marketing agency, but only at a fraction of the price.

He paused for a few seconds leading me to believe it was a massively stupid idea, haha, but to my surprise he eventually shot back with, “this is the best idea you’ve ever had – we need to build it.” Lol… Okay!

And just like that YouBots was born :)

Can’t say I ever imagined myself doing anything around AI, but it was one of those instances where it just clicked and I knew I’d regret it if I didn’t go for it. So we’ll see what happens! We already have a number of paying clients, and it’s been fun as hell working on the branding and building out the site…

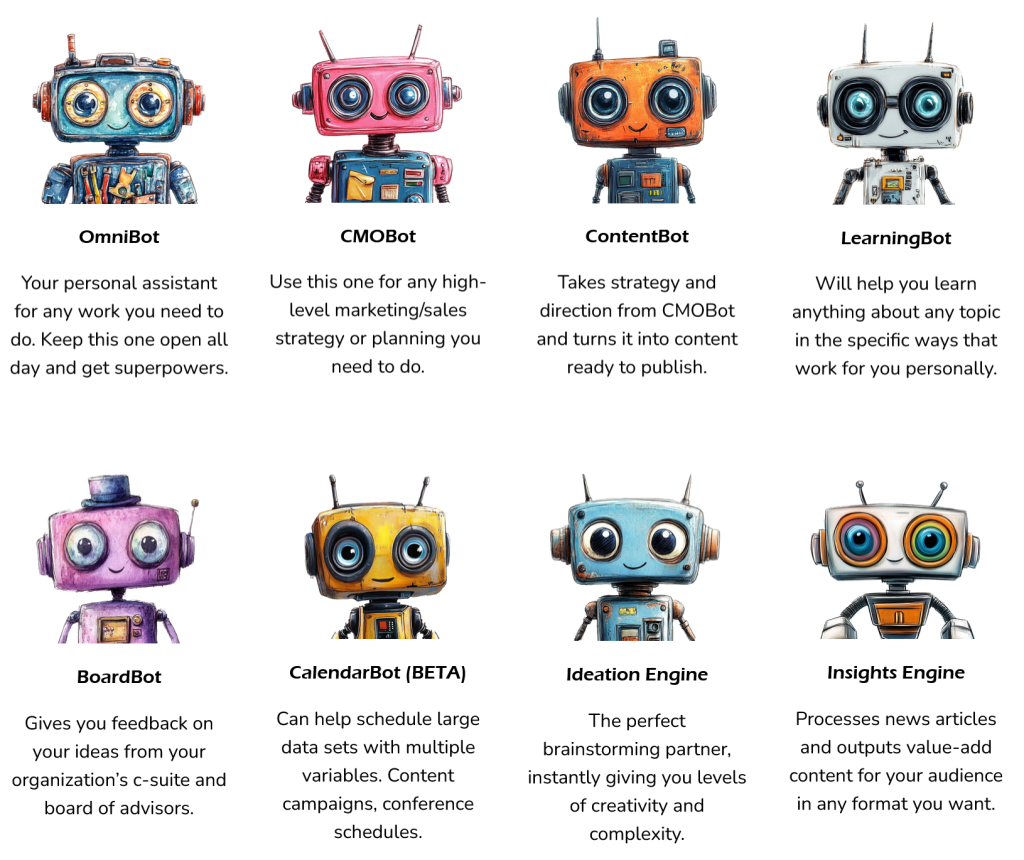

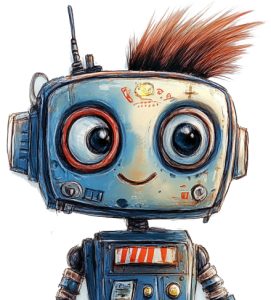

Just look at these cute little robots!!

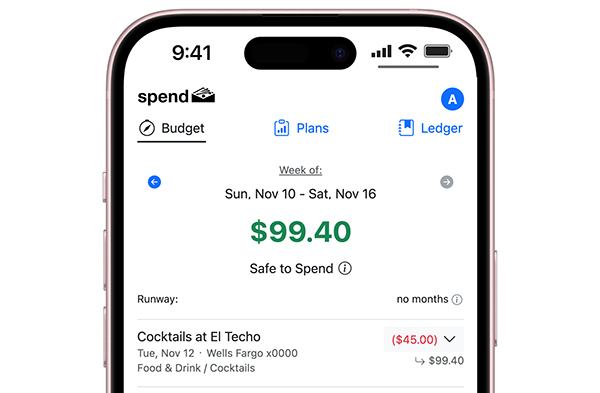

At any rate, if you run a business and wanna see if these bots can help YOU, check out our site and let me know what you think. It’s set up so that anyone on your team can use it without needing to know a thing about AI, prompt engineering, or even software development.

Our target audience is small-medium businesses who wish they had a bigger budget for hiring (both people and marketing agencies), so we’ve priced it with that in mind and one of our clients is already saving $4,000/mo. It’s beautiful.

Check it out –> YouBots.ai

We’re currently offering a one-week free trial, then 50% off the subscription cost while we’re in beta. No credit card required for the demo, and you can unsubscribe anytime.

So that’s what I’ve been up to over here! How about you? Anyone else dabbling in AI or working on a new project? Would love to learn all about it :)

Your long-time, non-AI powered, friend,

PS: I should note that while AI can do big huge amazing things to make your life and work better, I don’t believe it should be a substitute for YOU. To me it’s meant for *enhancing* your work, not replacing it.

*As previously seen on BudgetsAreSexy.com

*******

Favorite Reads Around the Community Lately:

“The Half Rule” – A Frugal Hack I Live By via Budgets Are Sexy — I initially caught this over on Frugal Confessions, but loved it so much I asked her if I could re-post it on Budgets and she said yes! So if you like it be sure to send your kudos to her as all I did was copy/paste ;) (I do really hope you’ll click it – it’ll get you thinking about it every time you do stuff!)

Is ‘Benefits Hacking’ Genius? Or Immoral? via The Best Interest — “Many government benefits are based on income, not net worth—so what happens when a wealthy person makes their income disappear? What happens when a millionaire is on food stamps – yes, you read that right. Is it savvy financial planning or an ethical gray area? Is this “benefits hacking” a way of unfairly gaming the system or justly playing by the rules?”

50 Years of Travel Tips via Kevin Kelly — “If you hire a driver, or use a taxi, offer to pay the driver to take you to visit their mother. They will ordinarily jump at the chance. They fulfill their filial duty and you will get easy entry into a local’s home, and a very high chance to taste some home cooking. Mother, driver, and you leave happy. This trick rarely fails.” (Hat Tip Apex Money)

How to Be a Part-Time Minimalist via Maximum Gratitude, Minimal Stuff — “The truth is, if you’re thinking about minimalism, weighing your options, and trying to make choices that are best for you rather than following the crowd to the mall or the big box store, you’re becoming minimalist. You’re learning to be intentional about your time, money, energy, and aspirations, and that’s a big step in the right direction. Maybe you’re not a minimalist in every single area of your life, but that’s okay. You can be a part-time minimalist.”

You’re More FI Than You Think via Millennial Revolution — “Your FIRE number will be very different depending on where you decide to live… New York FIRE and L.A FIRE are very different from ChiangMai FIRE and Oaxaca FIRE.”

Life Gets Better When You Stop Rushing Through It via No Sidebar — “I’m not going to tell you to try and ‘live in the present moment’ because I know reading that line doesn’t help. You need to force it out, because you can only live in the present when you realize that nothing ‘better’ is awaiting you in the future.”

How AI Shaves an Hour Off My Daily Reading Routine via Darius Foroux — “Knowledge is power—especially in today’s world. But here’s the catch: You must apply your knowledge. This is why I don’t want to spend too much time learning. I also want to have enough time to apply what I’ve learned.”

Is This Why Warren Buffett is Hoarding Cash? via Lazy Man and Money — “Over the weekend, Berkshire Hathaway revealed that it had $325 billion in cash and equivalents (US treasury bills). That’s enough money to buy half of Walmart or all of AT&T and have more than $100 billion left over. This isn’t the normal amount of cash he has on hand.”

******

Current Book I’m Reading

10% Happier: How I Tamed the Voice in My Head, Reduced Stress Without Losing My Edge, and Found Self-Help That Actually Works- A True Story by Dan Harris — “After having a nationally televised panic attack on Good Morning America, Dan Harris knew he had to make some changes. A lifelong nonbeliever, he found himself on a bizarre adventure involving a disgraced pastor, a mysterious self-help guru, and a gaggle of brain scientists. Eventually, Harris realized that the source of his problems was the very thing he always thought was his greatest asset: the incessant, insatiable voice in his head.”

(This is a super fun and interesting read – I always love hearing how drastically different peoples’ lives are, especially those in the public eye. And it’s always great to learn that they’re into the same things as I am too like meditation in this case! Though it has taken about 60% of the book so far to actually GET to the juicy meditation part, haha… It’s def. more autobiography than self-help…)

PS: Shout out to my friend Sarah for lending me this book!

******

Thanks for reading!

Have a fantastic week!

*Book links are Amazon affiliate links

// For previous newsletters: Archives

// To connect further: @Twitter | @Facebook | @Instagram | @LinkedIn