Failing at Early Retirement

Happy New Year!!

Did you have a great break away from things? Are you right back into them all again now and wishing you can figure out how to reverse time?! :)

I haven’t figured out exactly how to do that yet, but I did come to realize that if you just *don’t work at all* it def. slows down time, lol… So step 1) keep hustling until you’ve hit Financial Freedom! Then step 2) blow up all your schedules and start going with the flow :)

At least that’s my mantra for the new year after thoroughly enjoying my break and not wanting to come back to work right away, haha… I’ll still show up in your inbox every now and then and be somewhat productive, but I’m nixing all my self-imposed schedules for now and just going with whatever *moves me* in the mornings to see if it improves my overall quality of life. After all – if you can’t enjoy your hard work and money over the years, what’s the point right?!

So I’ll see you whenever I see you! Lots of great articles down below from the community as always…

HAPPY NEW YEAR 🎉

******

Posts Written By Me (or About Me) This Week:

The Year of The Flow 🤙 — I talk more about my New Year’s “theme” of going with the flow, as well as an update on life and my new obsession lately: PUZZLES!!! THE BEST!!

After Selling His Money Blog, This Founder Reacquired it 3 Years Later — For a Fraction of The Price @ TheyGotAcquired.com — An interview I did recently around selling, and then repurchasing, my main blog. Such a whirlwind of activity last year – I sometimes can’t even believe it!

******

Favorite Articles Around The Community Lately:

It’s Time to Work @ Of Dollars And Data – “Most people don’t get rich through their investment decisions, they get rich through their income. They get rich through their work. Even those who do get rich from their investments, typically, had to work to get the money they used to invest in the first place.”

Failing at Early Retirement @ Go Curry Cracker – “The idea that earning some income is equivalent to failure for an early retiree is common, but I think it is misplaced. There is no right/wrong or moral weight to the decision to add or subtract dollars from a retirement portfolio, so if something doesn’t feel right and you think work would help… then work.”

How to Stop Shopping Impulsively in 2023: 23 Frugal Tips! @ No Sidebar – “Does it feel like no matter how much you work, you can’t seem to stay on top of your finances? The problem may not be how much money you’re making, it may be the rate at which you spend it.”

Ten Words for 2023 @ The Humble Dollar – “Most of us are forever striving to be better versions of ourselves—usually with mixed success. Still, the changing of the calendar often prompts renewed efforts. But what should we focus on? Let me offer 10 words that I try to live by.”

In the Waiting @ Jillian Johnsrud – “I have a theory that people mostly buy lottery tickets for the waiting. That’s where the magic really is. From the time to buy your ticket until the numbers are drawn, you wait. You dream about what you might do or change if you are suddenly a billionaire. The buying isn’t so much fun. The numbers being drawn is quickly anticlimactic. But those few days waiting in between, your mind can run wild.”

The California Effect @ Mr. Money Mustache – “Start noticing your own bubble, and study the California Effect in your own lifestyle. Where do you see ridiculousness masquerading as normalcy? How can you extract the best of life in your area, while shedding the unnecessary downsides? How can you create an entirely new bubble of normal?”

3 Mindset Shifts That Will Change the Way You Think About Personal Finance @ Julie B. Rose – “Keeping the following in mind has made all the difference for me: 1) radical change isn’t permanent (and can have radical results!), 2) incremental goals are more attainable, and 3) lifestyle creep comes with an opportunity cost to something better.”

The Crypto Story @ Bloomberg – Where it came from, what it all means, and why it still matters” (This is a VERY long read, but wow is it helpful in understanding it all… And entertaining too!)

What Happens When You Get What You Want? @ White Coat Investor – “As Oscar Wilde said, “There are only two tragedies in life: one is not getting what one wants, and the other is getting it.” We all assume that the process of getting what we want will be hard but that having it will be easy. It turns out that’s a big lie. And nobody is talking about it.”

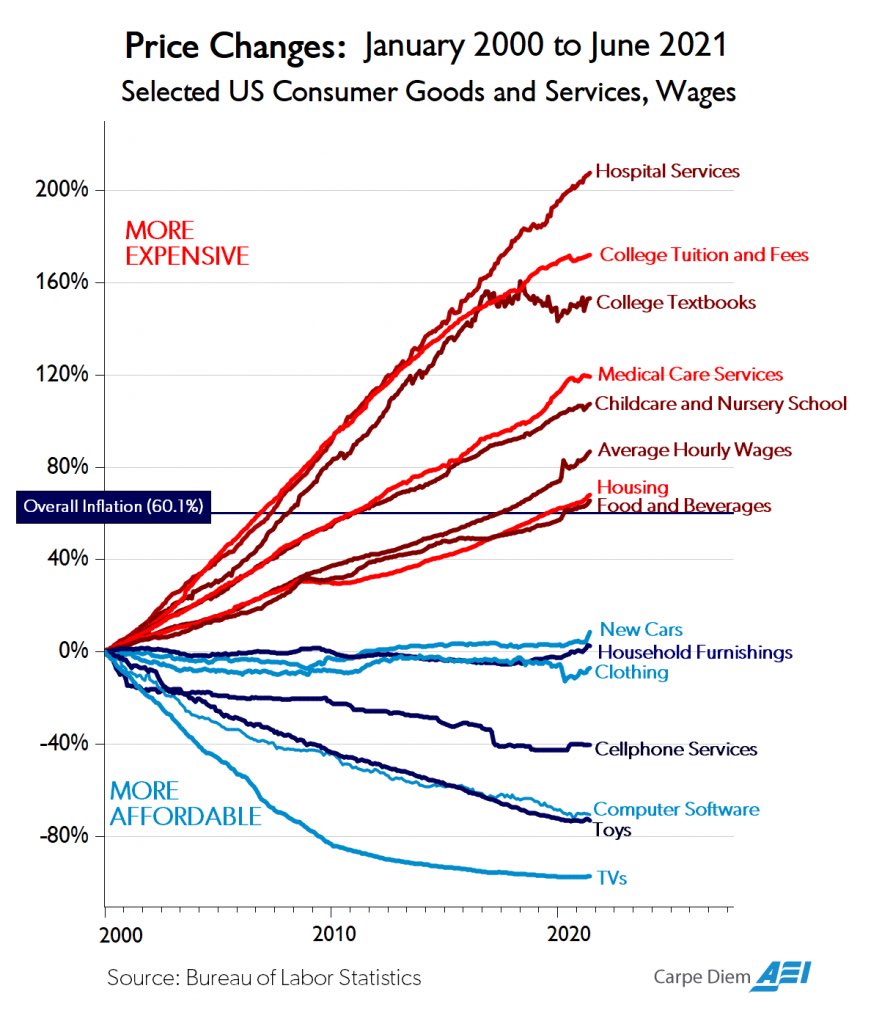

Price Changes Over Time, Some Things Have Become Ridiculously Cheap @ Accidental FIRE – “It’s crazy how cheap most electronics have become, and this chart only shows the trend since 2000. If you went back further it’d be even more stark. This past black Friday Walmart had a 64″ big screen TV for $260. That’s absurd.”

******

News From Around The Community

A bunch of interesting news that caught my attention recently:

- The Frugal Expat becomes a dad

- A Purple Life learns Spanish (in a year)

- Jonathan Mendonsa says goodbye to ChooseFI

- The Retirement Manifesto says goodbye to his 401(k)

- JL Collins says goodbye to Chautauqua

- Accidentally Retired puts out FIRE Insights Survey #9

- 1500 Days celebrates 10 years of blogging!

- The Minimalists celebrates 12 years of blogging

- 20 Something Finance celebrates 15 years of blogging

- Frugalwoods’ Uber Frugal Month has now started for January!

******

Clips From Around The Community

A bunch of interesting clips that caught my attention recently:

- “Leave the house five minutes earlier than usual. Give yourself permission to stop for a moment when something interesting catches your eye. Meander a little bit. Take a notebook and do what my husband did and write down some everyday observations. See how it makes you feel. You might like it.” – Simple and Straightforward

- “The dead outnumber the living 14 to 1, and we ignore the accumulated experience of such a huge majority of mankind at our peril.” – Niall Ferguson (via Collab Fund)

- “Every dollar you earn brings you that much closer to more choices. Having more choices is what makes us free.” – Steve Adcock

- “Stop and recognize happy moments when you’re in the middle of them. Literally stop and say out loud, “This is a happy time.” It’s a way to ground yourself in the joyful parts of your life. We do this with moments of trauma and crisis all the time. Maybe we should flip that script.” – 5AM Joel

- “If you have no idea how much is enough, you’ll never be satisfied with what you have.” – A Wealth of Common Sense

******

Stay cool.

// For previous newsletters: Archives

// To connect further: @Twitter | @Facebook | @Instagram | @LinkedIn

I have already read a couple of these, but now I need to read the rest. Thanks for the list!

Also, I read a great blog post by Morgan Housel this morning that you might enjoy (I think he published it yesterday):

https://collabfund.com/blog/the-art-and-science-of-spending-money/

You might have already came across it, but I really found it fascinating.