Just let your pile of good things grow.

Morning!

Got a few fun updates for you this week :)

Y’all hanging in there???

*******

#1. I’m back on Instagram again!

Which I still don’t get all the way, lol, but it’s been a fun way to engage with friends that don’t live on Twitter 24/7 like I do, and also a nice break from reading WORDS all day!

Come say hi if you hang out there! –> @jmoneyyyyyy

(Shout out to Jessica E. Boyd for art-ifying my profile pic)

#2. I added up a new collection on PF Swagger:

An apparel line by “Melanin Money” who’s on a mission to help 100,000 people of color invest their first $1,000 in the stock market 💪💪

I’m finding out a lot of the merch in our space has an underlying (and often, overt!) mission, and at the end of the day it really isn’t about the clothes themselves but what they represent.

Learning A TON, and while I can’t rock all these shirts for obvious reasons, haha, I’ve been having a blast getting the word out and meeting new creators in the PF world :)

Next on the list: loading up Stefanie’s “Statement Cards” which again has that strong principle behind it! “Dedicated to celebrating women’s ambitions and milestones beyond marriage and motherhood. ” A bit outside of our “apparel” scope here, but trying to keep the project flexible for now and see where it wants to go… And these cards def. have that swag!

About to start a One-on-One interview series too with the founders – so many interesting stories and backgrounds in our community!

And then something ALL y’all will probably find fun….

#3. I tried out a new money experiment!

Ever come across things you REALLY want, but they’re just too expensive for your frugal selves so you never end up pulling the trigger?

Well, after months of staring at something myself, I just couldn’t take it any longer and had to find a way TO GET IT. But without spending any of my own money :)

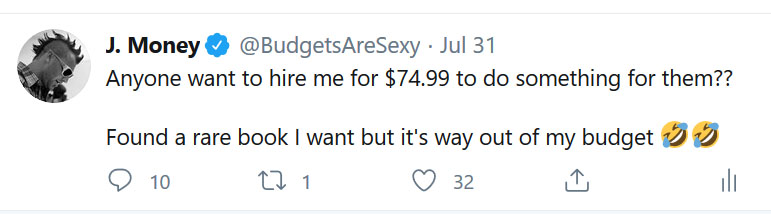

Came out with this random idea on Twitter and had some fascinating results!

#1. I got THREE bites! I think people like helping others accomplish their goals, especially when it’s so *direct* like this.

#2. It mostly revolved around *consulting*. One person wanted to interview me for a webinar on money, another person wanted my thoughts on curation and whether there’s room for more sites in the PF space for it (there is! we need as much help as we can get getting the word out!), and then the third wanted my help coming up with a “top” blogger list to go along with an article she was writing…

#3. I spent a little over 3 hours on it all, and incidentally made $225 in the process. But here’s the interesting thing – my consulting rates typically come out to around $150/hour but RARELY do I have this much fun doing them! And certainly not at half the rate! Haha…

Which leads me to the biggest takeaway: #4. When your $$$ is earmarked for something important to you it’s a lot more motivating to shoot for. Which is why people like to label their savings account like “Vacation Fund” or “New House” or “Early Retirement”, etc, etc… And something I know deep down, yet still forget over time and fall back into the “just get more money!” strategy which is a much harder slog. I was more motivated in these three hours of work this week than any other tasks all Summer! Lol… And all for a book!

*******

So that’s been my random week! :)

How about you?

Lots of chaos still out there, but also lots of things still in our control too.

I’m reminded of this quote 5AM Joel shared recently that I’ve tried to keep front and center:

“What if, instead of thinking about solving your whole life, you just think about adding additional good things. One at a time. Just let your pile of good things grow.” – Rainbow Rowell

Just let your pile of good things grow! YES!! And what’s so great about this is that it doesn’t allow you to cancel out any of your *bad* things too which our brains tend to want to do! It merely shifts your focus to all the POSITIVE things in your life to better keep you sane! Brilliant!

So good stuff to keep in mind as the year ticks on, and I hope each and everyone of you completely gets consumed with your own piles ;)

See ya back here again next week. God bless,

// For previous newsletters: Archives (below sign-up box)

// To connect further: @Twitter | @Facebook | @Instagram | @LinkedIn

*******

Favorite reads from around the web this week:

How to Splurge Without Guilt via A Lawyer And Her Money — “You only see others’ cheat days – not their everyday… Every year, I have one big $100 order at Sephora. That’s crazy money. And I think if someone had seen me do this (I mean I did it online, but let’s say I bought it in a store), one might think “she’s a spendthrift.” But you have no idea what the other 364 days of the year look like. I can spend whatever I like now during my year off because I spent my entire adult life living below my means.”

The Most Important Number in Personal Finance via Of Dollars and Data — “What is the most important number in personal finance? I used to think it was net worth, or possibly liquid net worth, but I have since come to the conclusion that these measures have some serious limitations… Let me present The Wealth Discipline Ratio™”

The “Be Do Have” Paradigm by David Yarian — “Does the following statement sound familiar to you? “If only I could HAVE a certain thing (enough money, free time, resources, new car,etc.), I would DO a certain thing (travel, do more fun activities, buy the things I want, etc.) and then I would BE a certain way (peaceful, calm, happy, etc.).””

Are Parking Spaces Profitable Investments? via Joney Talks — “What is really interesting here is that those two parking spots bought in the same city each show different results: Garage 1 was less modern but in an area with fewer parking spots. It offered lower profitability at first but then I was surprised when the real estate agent told me he managed to sell it for 50K. Garage 2 was in a more modern facility but then many extra unforeseen costs came along and it was more difficult to sell than expected.”

My Dividend Employee, Steve via Time in The Market — “Steve works 250 business days and 8 hour days. He delivers income each month based on my holdings. He reinvests everything for me because I’m in the growth stage right now, not in the withdrawal stage.”

A Roth IRA For Every Baby in America via A Wealth of Common Sense — “A lot of people are angry at the stock market right now as it continues to charge higher in the face of excruciating economic pain elsewhere. Instead of getting angry at stocks we should be doing our best to make sure more people are able to take part in the profits, cash flows and innovation produced by corporations. The stock market doesn’t care how unfair people think it is so we might as well figure out a way to help more people benefit from its growth.”

*******