Life Hacks & Pokémon Surprises

Morning!

If you’re reading this right now, it means I have Covid.

On the plus side, I’ve had nothing but time to read and write and think so there’s lots of great articles for you to gander down below 😁

I’m also feeling MUCH better than I was in the beginning (thanks Paxlovid!) so things aren’t looking too bad over here… Another cple of days and I can re-join society again – woo!! (Isolation is truly the worst… I literally stream Coffitivy 24/7 just to feel like I’m around people still, haha… (all it does is stream “coffee shop sounds”!! Genius!)

Pre-covid, however, I stumbled across 3 new life hacks for me and blogged about it here: 3 Random Life #Hacks. It covers mowing lawns, trash can ease, and remembering stuff when you’re naked 😏

Maybe you do some of these too??!

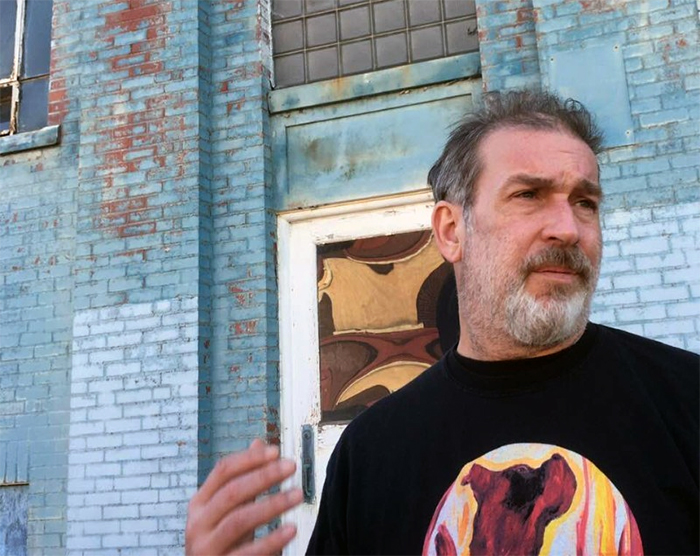

In other news, huge shout to Pat Flynn for totally making my kids’ year this week… You may remember him from his old school blog, Smart Passive Income, from a decade ago, but unbeknownst to me he started getting into Pokémon too and is apparently a pretty famous YouTuber now!

I had no idea. Until last week when I heard a voice that sounded awfully familiar on a video my boys were watching, and when it panned to the guy’s face I saw my old buddy Pat there! I screamed “I know that guy!” and my kids promptly LOST IT, haha… They couldn’t believe that I not only knew him, but even more impressively that we were friends! (*loose* friends, I should say… if we were that close I’d have known he was a famous YouTuber!! ;)) I DM’d Pat this, and he thought it was hilarious and told me to secretly shoot him my address and he’d send them over something special in the mail.

A few days later a big ol’ package landed on our doorstep and included not only a BRAND NEW box of Pokémon cards that were just released (!!!) but also came with three autographed cards from him and a nice letter thanking them for watching his show!! So nice!! They were mindblown and it’s all they’ve been talking about for days now :)

So thank you, sir!! You made 3 little boys (and their dad) super happy!

You can find Pat, and his Pokémon antics, @ DeepPocketMonster – it’s exceptionally good.

And that’s it for this week! Thanks for reading, and beware of the Covid!!!

Yours in isolation,

PS: That $1 note up top was found in my change! “Ben T. Is #1″ is scribbled in red, and then I think “Love, Gigi“? Hopefully they got together in the end ;)

*******

Articles I enjoyed around the web this week:

Hold Fast @ Happily Disengaged — “I’m not sure why the wack trend in the FIRE community these days is to demonize frugality and saving discipline. A rush of books and figure heads have come out that have pushed this alternative FI thread that sacrificing and delayed gratification is somehow suddenly a bad thing. Why the big change?”

My $1,000 Monthly Pension @ We Want Guac — “In my work towards financial independence, I have stumbled upon a monthly pension granting me $1000 every 30 days. I didn’t really review this until I sat down with my financial officer.”

It Happened Out of Nowhere @ Millionaire Habits — “It’s funny what happens when we stop using pharmaceuticals to mask legit problems. We stop the “Everything’s fine” charade and start fixing shit. I bet on myself. It paid off. I quit my job nine years ago.”

Tesla: BOOM or Doomed? @ 1500 Days — “On a silly whim, I bought Tesla stock back in 2012 and held on for dear life. It’s been a crazy ride, but now I’m a Teslanaire. I got extremely lucky. Like unicorn lucky. But never forget this: Most companies will die.”

The Second Bowl of Cereal and Other Economic Theories @ Poor. Choices. — “Cereal is great, but only a psychopath would eat a bowl of cereal for breakfast. In fact, I’m pretty sure Lord Voldemort ate cereal for breakfast. It’s in the 5th book. Look it up. No. True cereal aficionados know cereal is the perfect afternoon or late-night snack.”

How to Avoid Type 2 Money Mistakes @ Wallet Hacks — “Type 1 money mistake is one that is clearly bad at the time you make it. Paying for a Netflix subscription but never using it. Type 2 mistakes are more pernicious. It’s harder to identify because it’s the type of error that hurts you far into the future, long after the decision was made.”

If Your Employer Refuses To Negotiate Salary, Try These 11 Creative Counteroffers @ Bitches Get Riches — “When an employer refuses to negotiate salary, they’re giving you leverage to ask for other things. Today, I’ll give you a few ideas for creative counteroffers that will make your life better and sweeten any job transition. Even better, I’ll suggest some simple scripts you can follow to maximize your chances that they’ll say “yes.””

Friedrich Nietzsche: Amor Fati and Rejection of Objective Truths @ Darius Foroux — “Combining Nietzsche’s “amor fati” (love of fate) with his concept of “perspectivism” provides a powerful mental model for dealing with the challenges of today. I call it “open-minded resilience.””

Never Look Down the Road Not Taken @ Of Dollars and Data — “After winning the NBA championship in 1980, Johnson was offered sponsorship deals from Converse, Adidas, and Nike. While Converse offered the most money, Phil Knight, the head of Nike, told Johnson that instead of cash, he could give him shares of Nike. Johnson, not knowing much about stocks at the time, took the Converse deal. After all, money talks. But, when Johnson ran the numbers years later, he realized that the Nike stock he turned down would be worth nearly $5 billion today, or 8x his current net worth.”

******

Collaboration of The Week:

Santa Cruz + Pokémon skateboards!! AHHH!!! You literally OPEN THEM UP like packs of cards and get surprised by the board you get! And not only that – they have special golden ones you can “pull” that I’m sure will fetch a butt ton of money for those who find one, lol… They’re just like Willy Wonka’s golden ticket, only golden skateboards!! So rad!! 🤩

More here (they come out on the 13th) –> santacruzskateboards.com/pokemon

*******

// For previous newsletters: Archives

// To connect further: @Twitter | @Facebook | @Instagram | @LinkedIn