Live Boldly

Good morning friends!

When was the last time you did something truly BOLD? Like way outside your comfort zone but it needed to be done? This year? This month? This week? Can’t remember because it’s been so long?!

I love this newsletter heading that I stole from Mr. 1500 Days because it’s a great reminder to SHAKE THINGS UP every now and then to make sure we don’t get all stale and moldy up in here… A reminder I personally need right now, as much as you might.

It seems like every 3 months or so I get stagnant and boring and need to do something about it, and currently it’s been around 6 MONTHS since my last bold move (when I bought my blog back) and the time has definitely come for another… But the problem is I don’t have so much as even a *clue* as to what that move needs to be?! It’s maddening!

I’m sure it’ll dawn on me at some point, but if you’re currently struggling with something similar yourself, know that I’m here along with you and completely feel your pain :) And maybe let me know the closest you’ve come so far in figuring it out, and perhaps I can help you to pull the trigger / do it with you?! The push-up challenge from last week *could* be the start of something bigger here (there’s now 50 of us doing it!!), but I’m not quite sure it’s “it” just yet…

At any rate, favorite articles and news from the week are below as always, and I hope you have a most blessed, productive, FUN weekend over there! If you make any Big Moves I wanna hear about it, please!!

Yours in wishing to be bolder,

******

Posts on Budgets this week:

Side Hustle #85: Plant Propagation 🌱 — Another installment of our Side Hustle Series! Where our guest, Jim, digs in and shares a passion gig of his… Perfect for all those who love nature and gardening! I guess money really *can* grow on trees – heyo

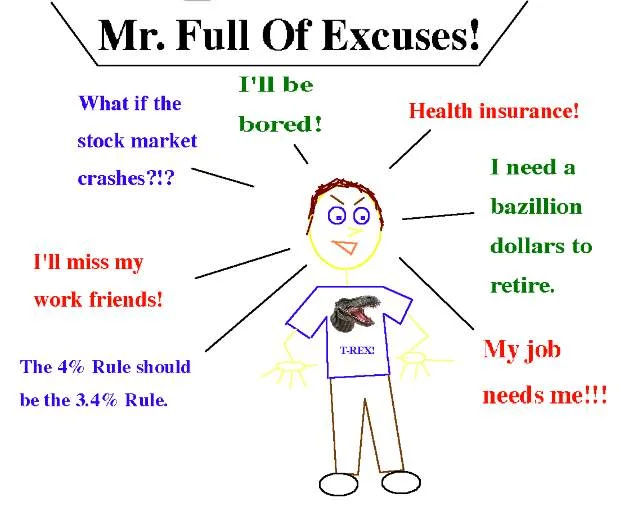

5 Things I’d Never Do as a Financial Advisor — I stole this from my friend’s Instagram feed because it was so great ;) It covers 401(k) plans, penny stocks, estate plans, salary requirements, and securing multiple streams of income. Do you agree or disagree?

*To get these posts automatically emailed to you on the day they come out, sign up to my blog newsletter here.

******

Favorite Articles Around The Community:

Live Boldly @ 1500 Days – “Great things don’t happen when you’re sitting around with a bad case of the “What ifs?” Normal effort yields normal results. Everything great happens when you push your a$$ out of your comfort zone.”

Live Boldly @ 1500 Days – “Great things don’t happen when you’re sitting around with a bad case of the “What ifs?” Normal effort yields normal results. Everything great happens when you push your a$$ out of your comfort zone.”

How to Stop Thinking Too Much @ Raptitude – “Being caught up in your own thinking is like having been kidnapped and held hostage by the most boring person on earth. You’re forced to listen, as though at gunpoint, to an internal commentator who insists on telling you its impressions of everything it notices or thinks about.”

How to Make Life-Changing Decisions @ Wallet Hacks – “Very few life choices are irreversible. I can’t think of many decisions in my life that I couldn’t, in some way, go back and change. You have an out on every one of your decisions.”

How Do You Know If You’re Frugal or Just Ridiculous? @ The Frugal Girl — “I think the line between frugal and cheap often comes down to a selfishness issue. When your money-saving efforts affect just you, and they don’t cause harm to anyone else, that’s frugal. When your money-saving efforts hurt or deprive someone else, that’s when you’ve crossed the line into cheap.”

It’s Time To Quit Your Job As A Grievance Entrepreneur @ A Teachable Moment – “Spending the day pondering what to be offended about on social media isn’t additive. There’s another direct road to unhappiness. Embrace the recency effect at your peril.”

The Golden Rule of Personal Finance @ The Best Interest – “I know. You think you know what I’m talking about. But in my ever-growing experience in personal finance, most people think they know this idea, but have not truly internalized it. It’s a foundational rule we too often ignore.”

******

News Around The Community:

Interesting news that caught my eye this week…

- Financial Mechanic has left Amsterdam and is now traveling through Bali!

- Frugalwoods has started UFM (Ultimate Frugal Month) Mastermind Groups

- The Retirement Manifesto is expanding their mountain homestead

- Accidental FIRE reflects on 5 years of semi-retirement

- How To Money has started a weekly newsletter

*******

Clips Around The Community:

Interesting clips that caught my eye this week…

- “If you buy something just because it’s on sale, you don’t need it.” – No Sidebar

- “My system in life is to figure out what’s really stupid and then avoid it. It doesn’t make me popular, but it prevents a lot of trouble.” – Charlie Munger, via DariusForoux.com

- “Just heard about this little trick, it’s called the good guy discount… When you’re at the store purchasing something or buying from someone, you say this… “Hey, I’m a good guy. You’re a good guy. Is there some type of good guy discount we could work out?” I hear it works pretty well. 🤷♂️” – 5AM Joel

- “I have a radical proposal. An experiment that might just change your life. If you want to try it, I’ll do it with you. It goes like this: Live most of your days according to your normal habits, doing your job and your everyday stuff the same as always. Then one day a week, let’s say Tuesday, you live by a specific dictum: From the minute you wake up, do without hesitation the thing that most needs to be done in each moment, regardless of how appealing it is. Bring your full attention to each such act, as though it’s your sole purpose on earth. Let go of every other concern.” – Raptitude

*******

New Book on The Scene!

Fellow reader KT shot me the heads up on this, and said it would be the perfect companion to the Legacy Binders I love oh so much – and she’d be right! Anything you can do to improve the lives of your loved ones when your gone is 🔥🔥🔥, so if you’re not in the mood to tack it just this second, at least out it on your radar for the immediate future…

More about the book, via Mike’s website (ObliviousInvestor.com):

Many surviving spouses find themselves overwhelmed by all the administrative and financial to-do items that have to be handled in the months after their spouse’s death. There’s a lot to do, and they’re supposed to get it all done while grieving. And in many cases, the situation is made more difficult by the fact that the surviving spouse is not the one who regularly handled the household finances.

I wrote this book to walk people through it, in plain language. It’s the book I want my spouse to have, in case something happens to me.

You can learn more/purchase it here: After the Death of Your Spouse

And then here’s where you can find some great Legacy Binders too for whenever you’re ready!

- Family Emergency Binder ($39, robust, pretty)

- Free Legacy Binder (FREE, simple)

- The Big Book of Everything (FREE, simple)

******

Video of The Week:

[Hat tip: A Gai Shan Life]

*******

HAPPY WEEKEND ✨

// For previous newsletters: Archives

// To connect further: @Twitter | @Facebook | @Instagram | @LinkedIn

Leave a Reply