FinCon, Friends & Favorites ✨

Good morning!

I survived FinCon!

Here are a bunch of pretty pics to prove it :)

Me and the incomparable Trip of a Lifestyle duo – Steven and Lauren. Who both retired at 29 and now travel the country and wherever they want! Been enjoying their blog for a few years now so was super excited to meet them in real life. And for all those who remember Money Mozart back in the day, that’s Chris Muller in the background photobombing us!

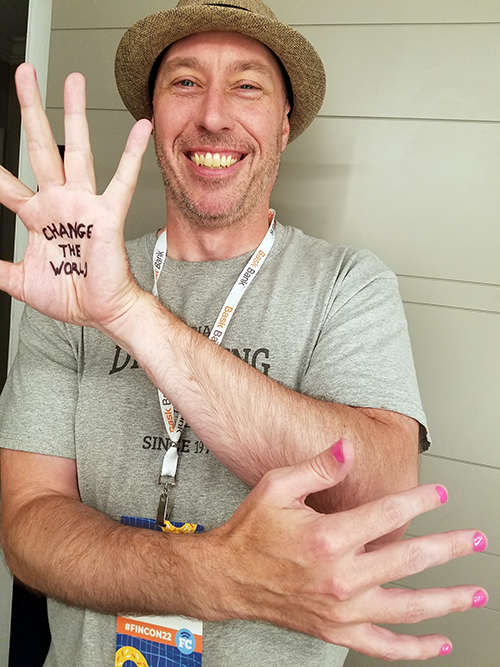

Me and my homeboy/roommate/business partner, Nate St. Pierre. Gotta love his tee he custom created, lol…

Me and Jeff from Homo Money on the left / Tom from The Frugal Gay on the right who BOTH brought home Plutus Award trophies making them officially award winners now!! Jeff took home Best New Personal Finance Blog and Tom won Best Real Estate Content for his Twitter account.

Dawned on me that they’re both also CLIENTS of my blog coaching services (which inspired this pic!), so either a) I’m super blessed to have amazing clients – OR – b) they became amazing from a little J. Money sprinkling, haha… But let’s definitely say it’s the former as they were already on their way ;) I only aim to ELEVATE!!! Congrats guys!

Nate all gussied up before our closing party… which if you know Nate you’ll now this is NOT LIKE HIM at all! Never have I seen him wear nail polish – especially pink polish! – nor rock a hat like that (it’s mine) or even *smile* for that matter 😂 But we must have caught him in a good mood, and he even went back to his 2010 roots of reminding everyone to Change The World.

And lastly, here was a shot of the pools and water slides right off our balcony… was hard to complain, that’s for sure ;) (Though I did make the mistake of sending it to my kids who were less than pleased that I came here without them!)

So as you can probably tell, I was glad I went, and somehow even managed to come back unscathed health-wise unlike my roomies who are just now finally recovering from a nasty flu a week later :(

I always wonder if it’ll be my last year there now having gone to 10 of them altogether (!), but seeing how next year’s will be in New Orleans, I don’t think I’ll be able to stop just yet ;)

There’s a killer ROTATING PIANO BAR there that I just have to re-visit again!

In the meantime though, we just keep doing our thing and seeing what the next year brings! Always makes for a great “check-in” on your business/blog/projects and you always tend to come away feeling re-motivated again…

So thanks to everyone who made it a point to stop by and say hi! And thanks to you all who continue to allow me into your lives and share my projects. Can’t do any of them without you. 🙏🙏

Favorite articles and clips from the week are down below, and will be back again next week for another fresh report…

Your (grateful) friend in finance,

Posts on Budgets this week:

This week was a full week of giveaways! Which all ended at the end of each day, but there’s still one last one live right now that ends at 5pm EST if you’re interested… Today we’re giving away a coin collecting package, a handful of financial greeting cards, some killer Vanguard mugs!, and a “Love and Money” course and books…

Click here or the picture below to enter for any of them:

PS: to get Budgets Are Sexy posts in your inbox the day they come out, subscribe to the newsletter here.

******

Favorite Reads Around The Community:

The Best Personal Finance Books for Every Stage of Your Money Journey @ Rich Frugal Life – “Since discovering the FIRE movement in late 2018, I’ve read dozens of personal finance books and hundreds of blog posts. Here are my picks for the best personal finance books for the different stages of your money journey…”

We Didn’t Start The FIRE: The True History of Financial Independence @ Get Rich Slowly — “Who started the FIRE movement? Who “invented” financial independence? Who first came up with the concept? Today, using my collection of old money books, let’s take a look at where the notion of financial independence originated.”

The Surprising Inspiration to Declutter I Found At the Museum @ No Sidebar – “If I could live for 1000 years, what would I keep? When I am gone, what do I want archaeologists to learn about me from my stuff? What about you?”

The “No Risk” Portfolio: Stock Upside Exposure with 100% Money Back Guarantee @ My Money Blog – “Insurance companies already sell complicated equity-indexed annuities that extend a form of this “no principal loss” to investing. But why not apply it to DIY investing?”

A Humanistic Concept of Net Worth @ Douglas Tsoi – “Here’s the truth: a person’s financial net worth has little to do with their human net worth. It says nothing about their resilience, their depth or their happiness. It does not define their participation in community or their generosity. Financial net worth is an advantage that some leverage for good and others flaunt or squander or worse.”

Do You Rent Or Own Your Job? @ Financial Panther – “You can rent a job. Or you can own a job. It’s not easy to own a job. And there’s nothing necessarily wrong with renting a job either. But for me, owning a job is the way I’d rather do it. If I’m going to have to work, I’d rather work at a job I made for myself, even if it means I have to take all the risks.”

Forgotten Treasures: The Stranger Things People Leave in Library Books @ Euro News – “The documents left in between book pages range from the tantalizing to the mundane: bookmarks of children’s art, Christmas snapshots, family photos, weekend to-do lists, letters written but never sent and notes from lovers. Each of them offers a snapshot of the life of the person who left it there.”

The Case for Timeshares – Who Should Buy @ Financial Success MD — “Not everyone should consider owning a timeshare. Meeting the following criteria first is crucial to becoming a happy timeshare owner. Those who do not meet these criteria, however, should not acquire a timeshare at any price, not even if it is free, because they will be unhappy.”

[EDITOR’S NOTE: Timeshares get a lot of bad press, and rightfully so, but there *are* people who thrive off them and absolutely love them! One of these is Dr. Cory S. Fawcett who I finally got to meet in person at Fincon this week, and who just came out with a book on the very topic: A Guide to Loving Your Timeshare: How to Get the Most for Your Money in Family Fun and Experiences. They may not be for everyone, but for some they can be great! And Fawcett has been taking advantage of them for over 20 years now…]

[Links to book are Amazon affiliate links]

*******

News Around The Community:

Some interesting news that caught my eye this week…

- Financial Mechanic just quit her job!

- Fiery Millennials got a promotion and a raise

- Julie B. Rose celebrates 2 years as a nomad

******

Clips From The Community:

Some interesting passages that caught my eye this week…

- “Every hour you spend exercising is likely to give you six to eight hours of additional healthy life. There is no other lifestyle change that even comes close.” – Of Dollars and Data

- “Some luxuries won’t make your life any better, but losing them after having experienced them will certainly make your life worse.” – Nassim Taleb (via Young Money)

- “Working such long hours is not good for your health. In fact the Japanese government recognise that more than 80 hours a month overtime can lead to certain risks. What are these risks? Well, you know. Just working yourself to death or Karoshi as the Japanese call it. In 2017, Miwa Sado (31) died according to a labour standards office, as a result from overworking. This is Karoshi. Death by overworking. In the lead up to her untimely death from heart failure, Miwa logged over 159 hours overtime in the prior month of work.” – Foundered

- “Petrichor”. It means: a pleasant smell that frequently accompanies the first rain after a long period of warm, dry weather. – 5AM Joel

******

Video of The Week:

Lots of people you’ll recognize in this! Including *myself* who kicks off the series with some financial tips (along with my grovely voice which I’m about to lose after days of talking non-stop!). Thx for having me on, Jason!

*******

And that’s it for this week!

Hit reply and tell me what you’ve been up to!

// For previous newsletters: Archives (below sign-up box)

// To connect further: @Twitter | @Facebook | @Instagram | @LinkedIn